Market overview

What is the state of the Industry and what trends can we expect in the boating industry in the future? Mike Derrett, Marine Marketing Consultant and International Boating Industry magazine correspondent for the Middle East and Asia offers his view of the current market and an .over the horizon. view of future threats to the industry.

The industry goes global

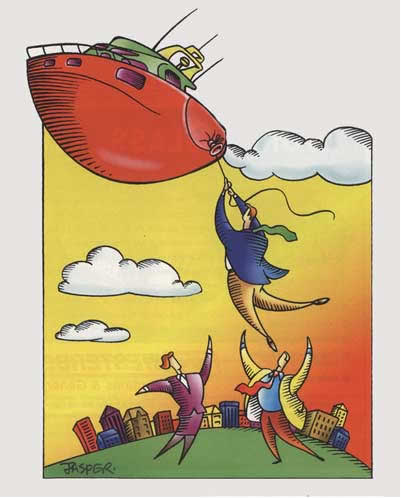

The world has shrunk! The speed and flexibility of modern communications and the improved speed of shipment by sea and air, coupled with lowering manufacturing costs from new locations such as China and India has put the latest products in front of consumers worldwide. The global market for goods and services has arrived and is having an impact on the boating industry as we compete not only with industry competitors, but also with the growing number of other activities for our share of the customer's discretionary spending power. Marine equipment and engine manufacturers have long been involved in a global market, but for boat manufacturers this era has only really developed over the past two decades as exports and imports have risen. Now boats built in the USA are exported to Thailand for use by an English expatriate working in Hong Kong with a holiday home in Phuket and some of the equipment on the boat will have originated in China, Mexico or other low cost manufacturing areas. As boat manufacturing becomes more global, with new areas of lower cost production opening up, we will see the industry develop new partnerships and grasp the synergies of working together in manufacturing and marketing, making a truly global market place.

Consolidation of the industry

Coupled with globalisation the number of boat manufacturers has reduced in the last decade with large multi brand industry groups such as Brunswick, Genmar, Ferretti, Azimut and Beneteau dominating the market with some rationalisation still to come. Smaller boat manufacturers can now only survive when operating in 'niche' markets that need special skills or are not large enough for the bigger players to consider. The equipment and component sector of the industry has seen major changes. Manufacturing of many components has moved to Asian countries with China a key player. Equipment distribution has seen the decline of the smaller chandler and the rise of on-line purchasing as the internet has revolutionised the way a customer can purchase.

|

|

Boat prices – are they rising out of control? |

As everyone in the industry is aware, production of boats is labour intensive compared with most other consumer products, and here lies a problem for the future, price! Without the massive economies of scale created by volume production of hundreds of thousands of units, as in the car industry, it is not economic to fully develop processes to automate boat manufacturing. Consequently, as labour costs increase in the developed countries, boat prices increase faster than most consumer products and demand falls, further compounding the problem. Research carried out in the UK in the late 1990's confirmed that in the UK (with the exception of small sailing cruisers) all boats were relatively less affordable than the equivalent car in 1967. On the other hand, the prices of equipment and services in the marine industry have all become relatively more affordable. However, without a boat who is going to use the services and equipment! There is no doubt that sales of smaller boats have been adversely affected whilst larger boats sales (fuelled by the existing customer base trading up in size) has been buoyant. This factor can readily be seen from the confidence surveys of many of the MIA's in this report where boats sales revenue is up, while the number of units has reduced. |

|

New manufacturing markets |

With the rising cost of manufacturing in the developed world and growing environmental restrictions on fibreglass production, companies are increasingly looking for lower cost locations to manufacture. Boat manufacturing at the lower end of the scale is low tech, labour intensive, environmentally polluting and crucially, low cost and easy to start up. This makes it an ideal industry for locations that have an abundance of low cost labour, giving rise to a developing industry in Poland, China, Sri Lanka and Mexico. With resultant savings on total manufacturing cost of up to 30%, boat manufacturers have the possibility to establish new manufacturing plants or outsource their production to sub-contractors and gain competitive advantage. The increasing cost of sea freight due the strength of global trade is another factor encouraging new manufacturing locations as considerable savings in cost and delivery time can be made by manufacturing regionally closer to new boating markets in Russia, the Gulf States and Asia.

|

New consumer boating markets |

As can be seen from the confidence surveys in this report, the lack of marina berths in most developed boating markets worldwide is a continuing problem with environmental and planning issues a major restriction on the growth of new marinas and boating facilities. The rise of Nimbyism (not in my back yard) and Cavemen (citizens against virtually everything) has grown to be a major problem and one that ICOMIA and the MIA's are continually addressing. However, it is encouraging to note that the surveys also show that most countries are positive about moves to rectify this shortcoming.

Boat owners in the northern part of Europe, encouraged by their unreliable weather have increasingly developed a trend to go south for their boating, just as North Americans have been going to Florida and the Caribbean. For Northern Europeans it's historically been to the Mediterranean. In recent times the growth of low cost airlines has expanded this and the number of boat owners has created a berthing shortage restricting boat sales. This has encouraged the growth of new and more exotic locations in Turkey, Dubai, Oman and even further away in South East Asia. Many of these locations have less stringent planning restrictions and are seeing rapid growth in waterfront residential developments with marinas. There are also advantages to be had in lower boat operating costs, lower taxes and sunny weather guaranteed.

With Asia now comprising 60% of the world's population and moving to centre stage, much industry effort is focussed on new markets in this region particularly China. However, the verdict is still out on how long they will take to materialise as cultural and Government restrictions on boating have to be overcome. The imposition of a 10% luxury tax on leisure boats in China earlier this year is not a positive sign.

|

New entrants to boating |

The increasing cost of a boat ownership is a worrying factor that has been masked in recent years by the trend for existing boat owners to trade up to larger boats. This has enabled many of the world's larger boat builders to prosper and grow on the back of an existing client base. It's only in recent years that the industry has been alarmed by the lack of new entrants. Today, unlike the inflationary 1970's and 1980's nobody counts on spiralling home equity or high inflation to finance their dream boat. With most boat prices high compared to other consumer products and activities, the value for money factor is lacking, especially for those vital new entrants to boating. Most MIA's tackle this problem pro-actively; with the NMMA leading the way with their 'Grow Boating' campaign.

The 21st century is a leaner and meaner place and we must make our industry even more efficient in manufacturing, distribution and service with the aim of making boating more affordable and value for money. In this respect we can learn a lot from the car industry especially in lean production, just in time supply chain processes and how to attract new customers and retain them with superior service. In this respect the concept of total boat warranty being introduced by many boat manufacturers, is a valuable lesson learnt.

|

Over the horizon – industry threats |

The boating industry world-wide is undoubtedly stronger than it was twenty years ago, it has consolidated and rationalised and is much more orientated to customer service. As for the future, the confidence level reports from the MIA's indicate almost all countries are planning to increase their investment in the industry. On the production aspect, just in time supply of components, lean manufacturing and the use of CAD and CADAM systems, (production methods that were virtually unknown two decades ago) are revolutionising the development of new designs and the manufacture of tooling. Collectively through the MIA's the industry pro-actively tackles weak areas, such as attracting vital new entrants to boating

But what of the threats? The big global issues that we can't as individual companies, MIA's or even as ICOMIA able to control? We live in a dangerous world and as an industry we need to be aware of these big issues and how they might affect us and take these risks into our decision making process. There are two key threats worthy of discussion, oil supply and price and the threat of terrorism and regional conflict, the two being interconnected with the price of oil being very vulnerable to regional insecurity in the Middle East.

|

Oil supply and price: |

The threat of 'Oil wars' is a very real one as global demand starts to exceed supply, the oil market is so volatile that even a small imbalance can drive up prices. With energy demands growing in developing countries such as China and India current world consumption of 84 million barrels of oil a day is forecast to rise to 121 million barrels by 2025, a figure that can not be achieved as resources of oil decline. In the next twenty years the dependency of the world's oil supply on Gulf oil producers will increase from the current 25% to nearly 50%' The implications are clear, oil prices will rise and the Gulf economies will grow even stronger opening up the opportunity of one of the world's most interesting growth markets for leisure boating. Unfortunately the resulting high oil prices in the rest of the world will make boating more expensive to the customer and put pressure on oil based materials used in boat manufacturing. Already demand from China for Stainless Steel and other raw materials is pushing up global prices.

|

Terrorism and regional conflict: |

In the past decade terrorism or the perceived threat of it, has become a major threat factor to be considered when making business decisions, especially in industries such as ours which are dependent on the discretionary spending power of the consumer. If security concerns were to tighten regulations on leisure boating, the effects would be numerous to an activity the main attraction of which is the freedom to escape from a regulated world. In the past four years boating has been subject to restrictions and controls in many parts of Asia and the Gulf for security reasons, it's likely that we will see these spread to more developed boating markets, especially if terrorism attacks spread from the aviation environment to the marine one. Apart from these direct effects the impact on the global economy would have massive implications for leisure boat sales. The worst scenario for the industry would be a major terrorist strike on the oil production facilities in the Gulf, with production centred on a few massive facilities; any prolonged reduction in supply would have far reaching implications for oil prices and likely put western economies into recession if not depression.

|

The sun still shines on another day! |

The reality is that boating has always been under pressure from one aspect or another and it has endured many peaks and troughs in the past. The economic outlook for the industry over the next two to three years is generally high, as shown by confidence level reports from the MIA's. Maybe surprisingly so with the slight signs of slowdown in the major boating markets of the USA and Europe that are also evident. The bottom line appears to be that it takes a lot to deter many customers from their passion of boating.

Long may it continue!

|

Mike Derrett

Marine Marketing Consultant

25th September 2006. |

|